ny mobile sports betting tax

The state will claim 51 of the operators gross gambling revenue compared to a median tax rate of 11 nationwide. New York Gambling And Taxes.

New York Sports Betting Licenses Going To Fanduel Caesars 7 Others Sportico Com

Winnings up to 8500 is subjected to the minimum 4 which should cover most NY sports.

. If you had New York City tax withheld from your gambling winnings add that to any other NYC withholding and put it on Line 73 of your IT-201. NEW YORK Lawmakers in New York are continuing efforts to rework the current 51 sports betting tax rate in place by regulation. If just one more came online the tax rate would fall to 35.

Legalized mobile sports betting in New York has generated practically 2 billion in wagers and 70 million in state tax Tuesday February 15 2022 No Result. Bidders given til next Monday 5pm to amend their proposals if their plans dont match the tax rate levels. The official Request for.

The legalization of adult-use cannabis and mobile sports betting will both contribute to the largest state budget in New Yorks history this year. It would fall to 25 if at least 15 mobile sports books were operating in the state. The bill would also make those promotional efforts such as free wagers tax.

For the first time since opening weekend overall weekly betting handle fell under the 300 million threshold. But if your income is over 1077550 then. So if your income is less than 8500 youll have to pay the lowest tax rate of 4.

Sports betting market and a major hurdle that keeps some new operators from joining in. Mobile handle hit its lowest monthly mark since launching in January at 139 billion but an overperforming FanDuel helped push mobile. October 21 2021.

Estimates through May 1. The Commission also confirmed that a GGR rate of up to 64 could apply to applicants. Since then more than 198 billion in wagers has been taken in New York.

If you thought that the proposed 50 tax rate for New York mobile sports betting was too high then brace yourselves. Total State Tax Revenue. NYS regulators have come up with a final tax rate matrix that mobile sports betting bidders must be able to meet.

The lowest rate is 2 whereas the highest is just under 6 at 575. New York has already received 200 million in license fees from mobile sports operators and the companies have agreed to pay a 51 percent tax on gross revenues a split that far outpaces the. Pretlow has expressed frustration with the states mobile sports betting selection process and according to some news sources the 51.

However the New York State tax rate for gambling varies according to your income. In Maryland there is a gambling winnings tax rate of 875. You can win 10000 as long as it is spread out between smaller.

Pretlow And The New York Mobile Selection Process. Total NY Betting Handle. The Highest Tax Rate Has Been Selected According to the Commission.

It was never expected that the mobile NY sports betting market would be immune to the annual spring and summer revenue slowdown. The session deadline for the bill is June 2 2022 if they aim to see the changes made this year. The federal tax rate for all kinds of gambling winnings is 24.

A 51 tax rate on profits significantly higher than the 13 rate on mobile bets in New Jersey or the 10 in Colorado both sportsbook-friendly states. That makes New Yorks model a revenue share between the state and its nine sportsbooks Daniel Wallach an attorney and preeminent figure in the gaming and sports betting world said this week. Mobile sports betting operators deadline to amend their proposed tax contribution expires today at 5 PM as told by the New York State Gaming Commission NYSGC.

In the first 30 days of operation mobile sports betting generated 70 million in tax revenue for the state setting a monthly record among all states that have legalized the game. The increase in mobile sportsbooks would happen gradually and as more joined in they would all see a decrease in the 51 tax rate now applied in New York the highest of any other US. Tom Precious TomPreciousALB October 19 2021.

This does not explicitly state sports betting but it. The State Gaming Commission has just confirmed that the new and improved tax rate will be no less than 64 the highest in the nation. In New York 98 of the tax revenue goes toward the states education fund and is distributed to local school districts.

That said Aprils numbers are far from disappointing especially from the states perspective. Sports betting platform providers will also have to pay a. The operators who applied for licenses to provide mobile sports bets in.

The total Gross Gaming Revenue was over 138 million and at a 51 tax rate for the State these wagers brought more than 706 million in tax revenue. The bill introduced by Addabbo and Pretlow would gradually lower the rate as more sportsbooks begin operating in New York. As long as no single ticket or betslip pays more than 599 they are not supposed to tax you and you are not supposed to report it.

If there was Yonkers tax withheld add it to your total for that withholding for the year and put the sum on Line 74 of your IT-201. Total NY Betting Revenue. Overall Mobile Sports Betting Revenue Totals For New York.

New York Mobile Betting Tax Rate. Each new sportsbook would still pay an initial one-time licensing fee of. New York has benefited greatly from the 51 tax rate taking in 1636 million in taxes since launch.

But tax revenues from online sports wagers will. How much tax youll need to pay on sports betting wins in New York. Mobile sports wagering began in New York State on January 8 2022.

Once you pass that threshold you will have to pay both federal and state tax on your winnings from sports betting. NY Sports Betting White Paper. The federal tax rate on winnings is a flat 24 while the New York State tax ranges from 4 - 882 depending on how much youve won.

New Bill Would Cut New York S Mobile Sports Betting Tax Rate In Half City State New York

Sports Betting In Mass Gains Momentum But College Sports Credit Card Bets Remain Friction Points Masslive Com

New York Mobile Sports Betting Set To Kick Off

New York Online Sports Betting Exceeds 1 1 Billion In Total Handle

Full Page Layout For Kiplingers Personal Finance Magazine Illustration Doodlesandstuff Andrewjoyce Illustrator Illustrated Drawing Procre イラストレーター イラスト

New York May Surpass 1b In First Full Month Of Mobile Sports Betting Being Legalized Cbssports Com

Show Me The Money Sports Betting Off And Running The Pew Charitable Trusts Sports Betting Show Me The Money Betting

New York Approves Mobile Sports Betting For 9 Operators S P Global Market Intelligence

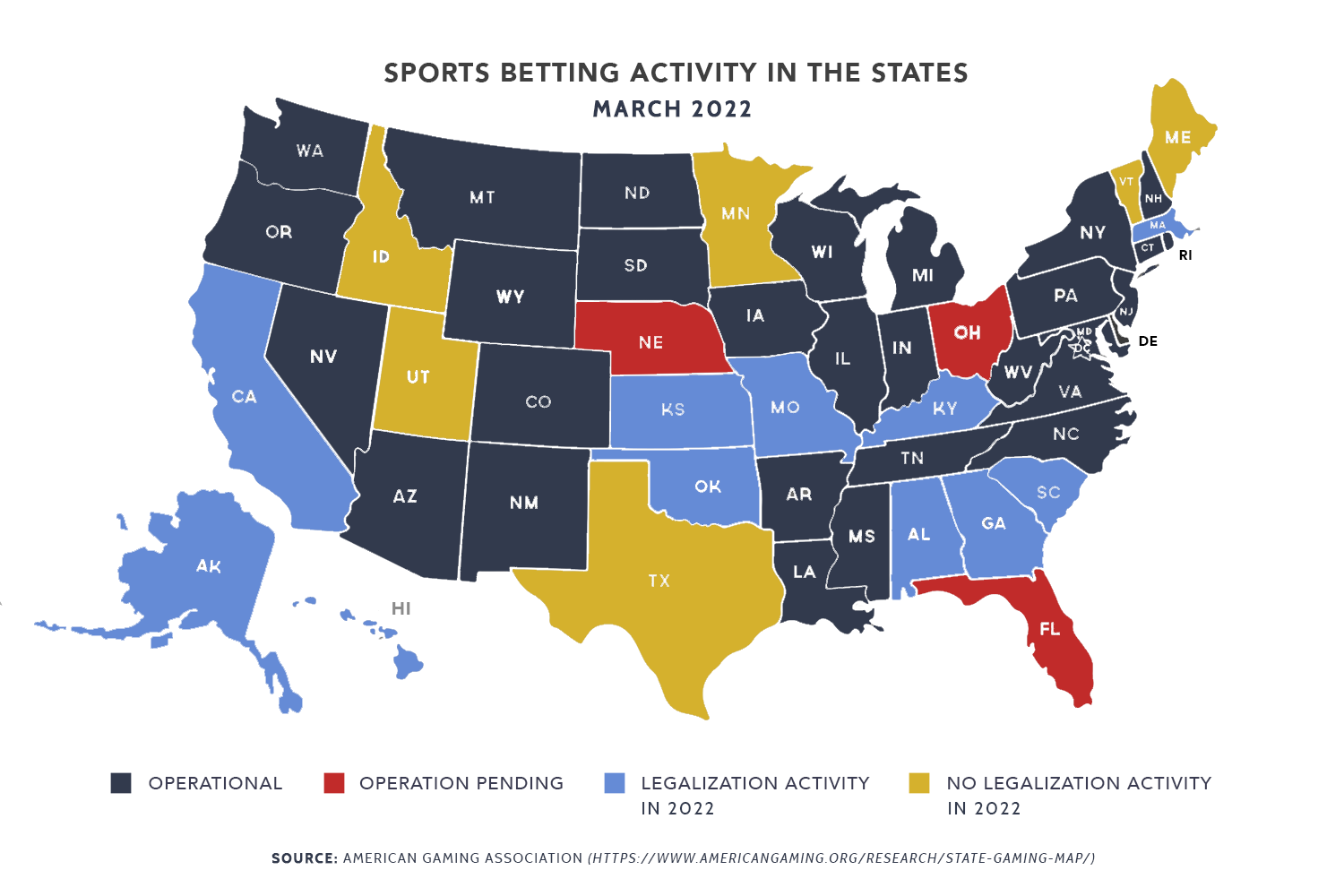

States With Legal Online Sports Betting Who Could Be Next In 2020 Sports Betting Betting Sportsbook

Ohio Online Sports Betting When Will Betting Apps Launch

Ny Mobile Sports Betting Could Break 1b In First Month

Nyc Sports Betting Are Winnings Subject To Taxes Silive Com

Georgia Online Sports Betting Which Mobile Sportsbook Apps Can We Expect

The Editorial Board New York S Embrace Of Mobile Wagering Fuels Troubling Rise In Problem Gambling Editorial Buffalonews Com

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Assessing State Sports Betting Structures Aaf

Want To Try Mobile Sports Betting In New York What You Need To Know

Four Sports Betting Apps Are Expected To Launch In Ny On Saturday